A tax filer, whether an individual or an organization, plays a crucial role in Pakistan's financial system by reporting taxes to the Federal Board of Revenue (FBR). Their responsibilities include accurately maintaining financial records, ensuring compliance with tax laws, and filing tax returns. With expertise in tax filings, they assist businesses in navigating complex regulations and fulfilling their tax obligations. In a country where financial transparency is key to economic stability, tax filers serve as vital contributors to maintaining compliance and fostering growth.

Tax Filer Status in Pakistan

In Pakistan, being a tax filer is a legal obligation and a significant step towards contributing to the country's development and economic stability. Becoming a tax filer involves several steps and requirements, but with the proper guidance, it can be navigated smoothly. This comprehensive guide will walk you through becoming a tax filer in Pakistan.

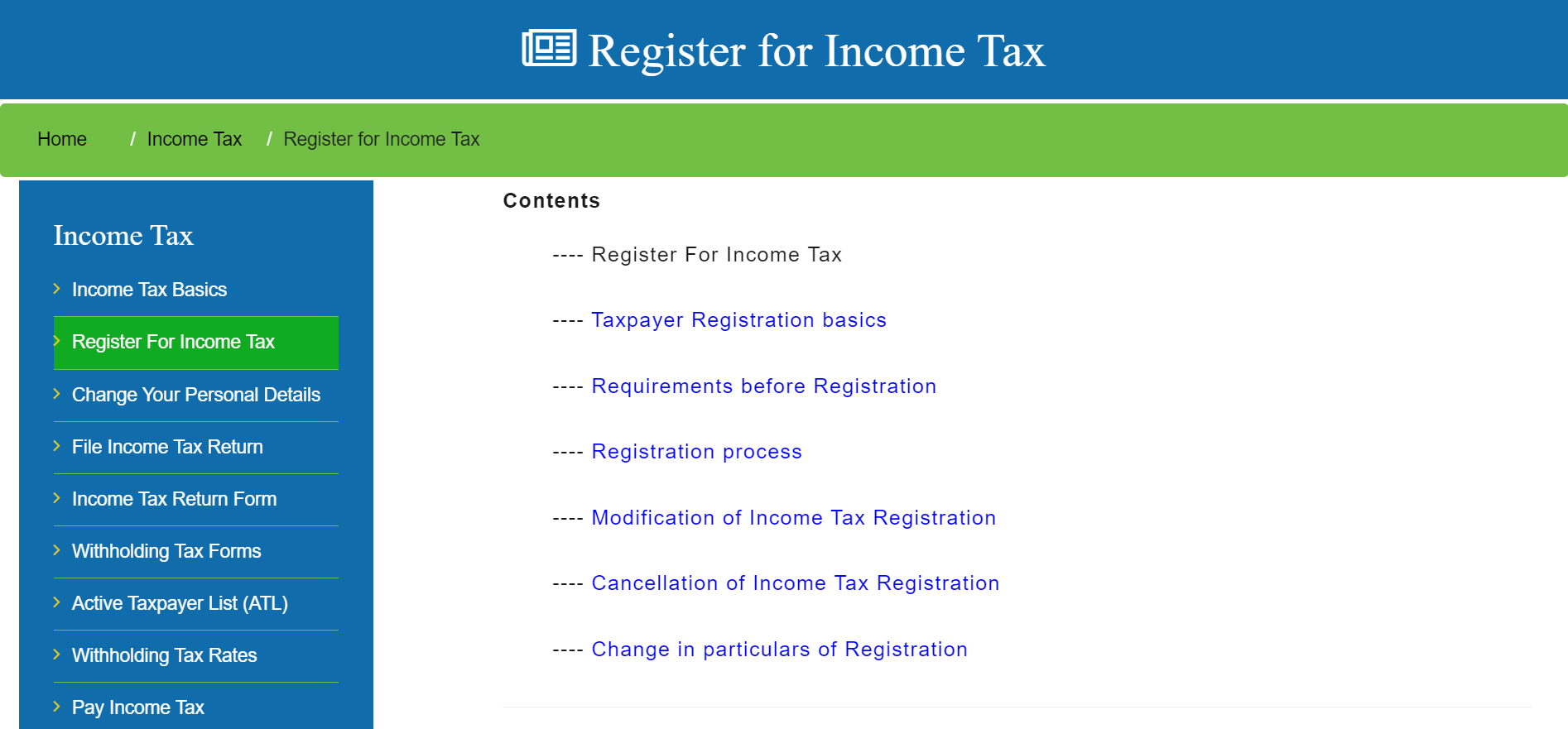

Checking Your Filer Status

The first step in becoming a tax filer is determining your current filer status. This can be done by following a few simple steps:

Visit the FBR Website: Head to the official website of the Federal Board of Revenue (FBR) at www.fbr.gov.pk

Access Online Services: Navigate to the "Online Services" tab on the FBR website.

Select Filer Status Inquiry: Choose the option for "Filer Status Inquiry" from the list of online services.

Enter Your NTN: Input your national tax number (NTN), which is the unique identifier assigned to tax filers in Pakistan.

Check Your Filer Status: The FBR website will display your current filer status, indicating whether you are a tax filer, a non-filer, or a provisional filer.

Requirements for Tax Filing in Pakistan

- Copy of Computerized National Identity Card (CNIC)

- Registered mobile phone number

- Total salary earned during the last fiscal year

- Bank statement for the current fiscal year

- Bank statements and certificates reflecting tax deductions made

- Comprehensive details of owned assets

How to Become a Tax Filer- Step-by-step Guide

Once you've determined your eligibility and confirmed your non-filer status, you can proceed with the process of becoming a tax filer:

Step 1: Assess Eligibility for Tax Filing

Before proceeding, ensure you meet the eligibility criteria for filing taxes in Pakistan. This includes individuals earning taxable income, companies, and entities engaged in business activities within the country.

Step 2: Initiate Registration with the FBR

To become a tax filer, initiate the registration process with the Federal Board of Revenue (FBR). This involves completing an application form and providing necessary documents, such as a copy of your national identity card or business registration certificate. Registration can be conveniently completed in person or online through the FBR's e-portal.

Step 3: National Tax Number (NTN) Registration

Upon successful registration with the FBR, you will receive a National Tax Number (NTN), serving as a unique identifier for tax-related transactions.

Step 4: Submit Tax Returns

Regularly submit tax returns to the FBR to report your income and any taxes owed. Ensure timely submission by the designated due date, usually by the end of June each year. You can file your returns online through the FBR's e-portal or at a tax office.

Step 5: Fulfill Tax Obligations

Ensure prompt payment of any taxes owed to avoid penalties and interest charges. Utilize various payment channels such as online banking, mobile banking, and authorized banks in Pakistan for seamless transactions.

_fdd59559-5df5-4975-878d-4c6702f64735.jpg)

Conclusion

Becoming a tax filer in Pakistan is a fundamental responsibility that contributes to economic growth and development. By following the outlined steps and fulfilling the requirements, individuals and entities can ensure compliance with tax laws and regulations. Remember, being a tax filer not only fulfills your legal obligations but also demonstrates your commitment to the progress of Pakistan's economy.

Learn How to get m-tag in Pakistan with our guide. Keep reading Ilaan's blog section for more informative posts.

Recent Blog

10 Smart & Simple Tricks to Cool Your Home Th...

29 Jun 2025

Budget 2025-26 Breakdown: Reforms, Real Estat...

25 Jun 2025

How to Stay Safe on Your Northern Getaway Whi...

14 Jun 2025

Top 7 Online Qurbani Services in Pakistan for...

29 May 2025